On this course you will learn:

- Explain relevant differences between Isle of Man (IoM) and UK payroll

- Recognise implications of employee tax code and calculate correct amount of income tax payable

- Calculate National Insurance contributions

- Demonstrate awareness of the rules pertaining to benefits in kind

- Demonstrate awareness of relevant employment law

Courses are delivered using the IPPE Online Learning Portal. Once registered for the course, you will be introduced to the topics covered throughout the hour and the course learning outcomes. Learning is achieved via a step-by-step process throughout the module, with a short test at the end of each topic, ensuring you have a full understanding of the course.

The e-learning course guides you through:

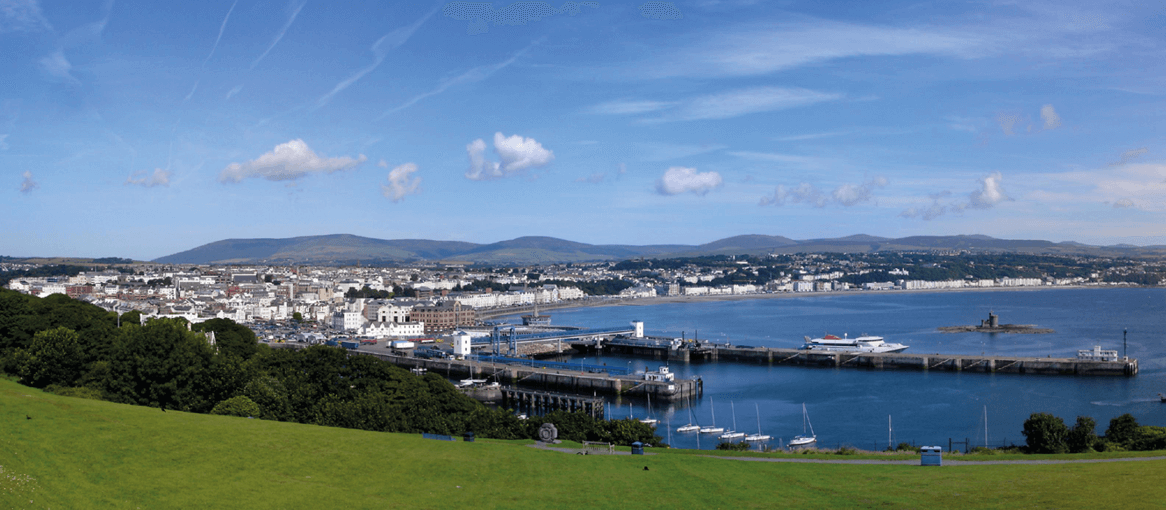

The background of Isle of Man payroll

- The relationship with the EU

- Citizenship

- Work permits

Income tax

- Rate of Tax and personal allowances

- Income tax Installation payments

- Registering got ITIP

- Free pay, standard and higher tax tables

- Special tax codes

Starters and leavers

- Remittance of ITIP and NICs

National insurance

- Classes of contribution

- Differences to the rUK National insurance

- Incapacity benefit

- Maternity and adoption as well as Parental allowance

- Grossing up adjustments to occupational payments

Employment law

- Minimum wage

- Annual leave

- Minimum notice and redundancy

Payroll update as this course helps build your expertise and confidence by providing detailed explanations and practical information about recent, current and proposed changes in tax, NICs, employment law, deductions and statutory payments.

Global mobility

Key payroll issues as this course develops the delegates knowledge on the implications of both impact and expat movements on payroll.

One hour, complete within 21 days of access from purchase date.